What is an NFT?

Day 1: 30 Days of Crypto-modeling

This post kicks of 30 consecutive days of posts related to understanding and modeling cryptocurrency related economic activity. I will not cover hype and speculation. Rather, our goal will be to gain insight into the fundamentals and see where quantitative theories from economics and behavior economics can provide insight.

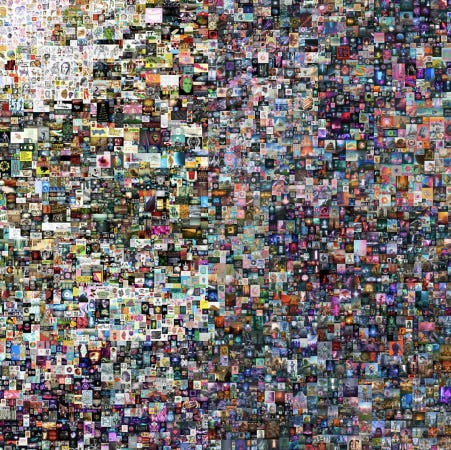

Recently, Digital artist Beeple sold an Ethereum blockchain-supported digital artwork called Everydays: The First 5,000 Days, a mosaic of individual works of art he created once every day for 14 years.

The work was sold for $60.25 million by Christie's, a centuries-old auction house, and received a total of 353 bids.

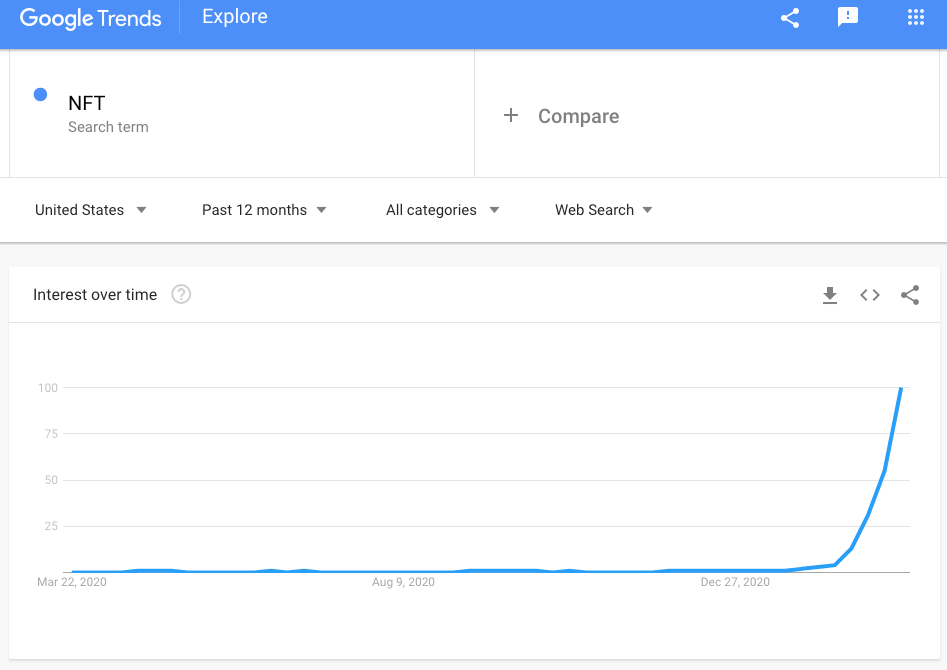

The unprecedented auction and the overnight minting of a multimillionaire set of a wave of speculative frenzy around non-fungible tokens (NFTs), the Ethereum blockchain technology that made the auction possible. Doubtlessly this current surge in NFT activity is a bubble.

After it pops, will anything of interest remain? I think the answer is yes.

What is an NFT?

In economics, fungibility is the property of a good or commodity whose individual units are essentially interchangeable, and each of its parts is indistinguishable from the others. For example, gold is fungible. If I bought a 10-ounce pure gold ingot in India and the same in Belgium, I'd have 20 * X USD worth of pure gold, where X is the spot price for an ounce of gold. If I cut each ingot in half and smelted the Indian halves into the Belgian halves, I'd still have the same value in USD.

Fungibility is related to but not synonymous with liquidity. Gold is fungible, but if I had a large amount of it and want to convert it USD, I couldn't just walk to my bank and plop it on the counter and ask for the cash to be in $20 denominations. Liquidating the gold would take some work.

Cryptocurrencies like Bitcoin and Ether are designed to be fungible. They are more liquid than they used to be because crypto-brokerages are commonplace. The first time I sold Bitcoin was face-to-face at a Jimmy Hortens in Toronto (nice guy, I wonder what he's up to?).

In contrast to crypto-currencies, the purpose of a non-fungible cryptographic token is to represent digital assets whose value depends on their lack of mutual interchangeability. In other words, NFTs represent assets that are valuable because they are unique. Where ordinary digital assets can be copied willy nilly, NFTs provide a way to create verifiable digital scarcity and digital ownership.

A non-fungible token is a cryptographic token that represents something unique; NFTs are thus not mutually interchangeable. They are used to create verifiable digital scarcity, digital owndership.

A primary application is the kind of digital art that Beeple produces as well as other digital collectibles. Collectibles are non-fungible by definition; if you and I were trading baseball cards or Pokemon cards, cards representing any two different players or Pokemon should not be interchangeable, or else that would defeat the purpose.

Stay tuned for more. But mind you, I am by not a crypto-economist, I only play one in this newsletter. If you have thoughts or feedback or know someone who might, please comment/share.